To receive payments from customers for goods and services, you need to connect a payment system to your site. One-time payments for goods or a subscription to an information service - in both cases we're talking about the same solution. If your Drupal site needs a payment system, check out our article.

Types of payment platforms and how they differ

If it's time to implement a payment system on your Drupal site, you have to choose the best option for your case. Payment systems differ in the way they collect fees, payment percentages, availability of support and many other nuances. We will describe only their main differences:

- Internet-acquiring banks - the bank helps the visitor to make a payment through the Internet: it checks the card data, debits the client's money and transfers it to the merchant's account (Sberbank, Alfa-Bank, Tinkoff, etc.);

- electronic wallets - the organization sets up a checking account, which receives funds from the client's electronic wallet (YooMoney, Webmoney, PayPal);

- payment aggregators - connect several payment methods to the site at once: by card, electronic currency, cash upon receipt, etc. (PayAnyWay, Fondy, YooKassa, CloudPayments, etc.).

We will not describe pros and cons of all these methods. In addition, the choice depends only on the tasks of your business, the stage of its development, tariffs, the level of support service of payment systems, etc.

One-time payments, subscriptions and donations

Drupal allows you to integrate any payment system for any purpose:

- subscription to content access services for any period of time with automatic debit on the desired date;

- regular and one-time donations;

- shopping payment.

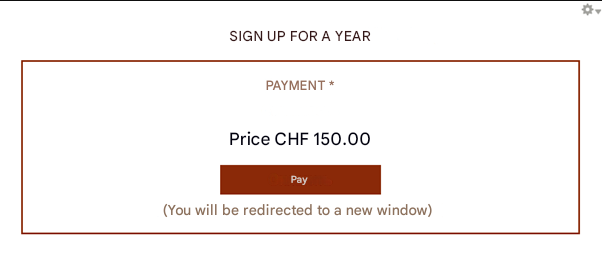

For example, our client www.nashagazeta.ch, a Swiss news portal in Russian, has a PayPal payment system with six-month and one-year subscriptions.

The nuances of legislation and user experience

For the client to part with the card data is very stressful, especially if they are on the site for the first time. That's why the payment form itself has to be convenient and look reliable to arouse trust. We think about the architecture of the page so that the payment form adapts to any device, especially smartphones which now account for more than 60% of all Internet traffic. You can place the payment form within the site or set it to open in a new tab with a link to the payment site. This depends on the specifics of the platform and the wishes of the site owner.

Be sure to pay attention to the requirements of the law and 54-FZ: it is important to set up fiscalization, sending receipts to customers and to the Federal Tax Service. All of these requirements may be taken into account by the payment system, or may require additional configuration. We are in the business of configuring these parameters and can also help with the necessary requirements.

How long does it take to implement?

According to the experience of past projects, on average it takes our developers 40 hours to implement a payment system. The question is that for some systems there are already typical solutions, while others will require custom development.

After implementation, we do full testing of all payment steps, so that your client is immediately in a friendly environment without bugs and errors.

If you want to connect the payment system to the site on Drupal, please contact us. please contact us.

Add new comment